The short answer is between 15-30%.

Why I invested in my PMS Hospitable.com vs. buying a new rental.

Blog Summary:

- Hospitable is a PMS (Property Management Software) that automates routine tasks for short-term rental owners

- Hospitable invites customers to Townhalls every 2-weeks to share product updates, get feedback on roadmap items, general company updates -- this makes customers feel like part of the company

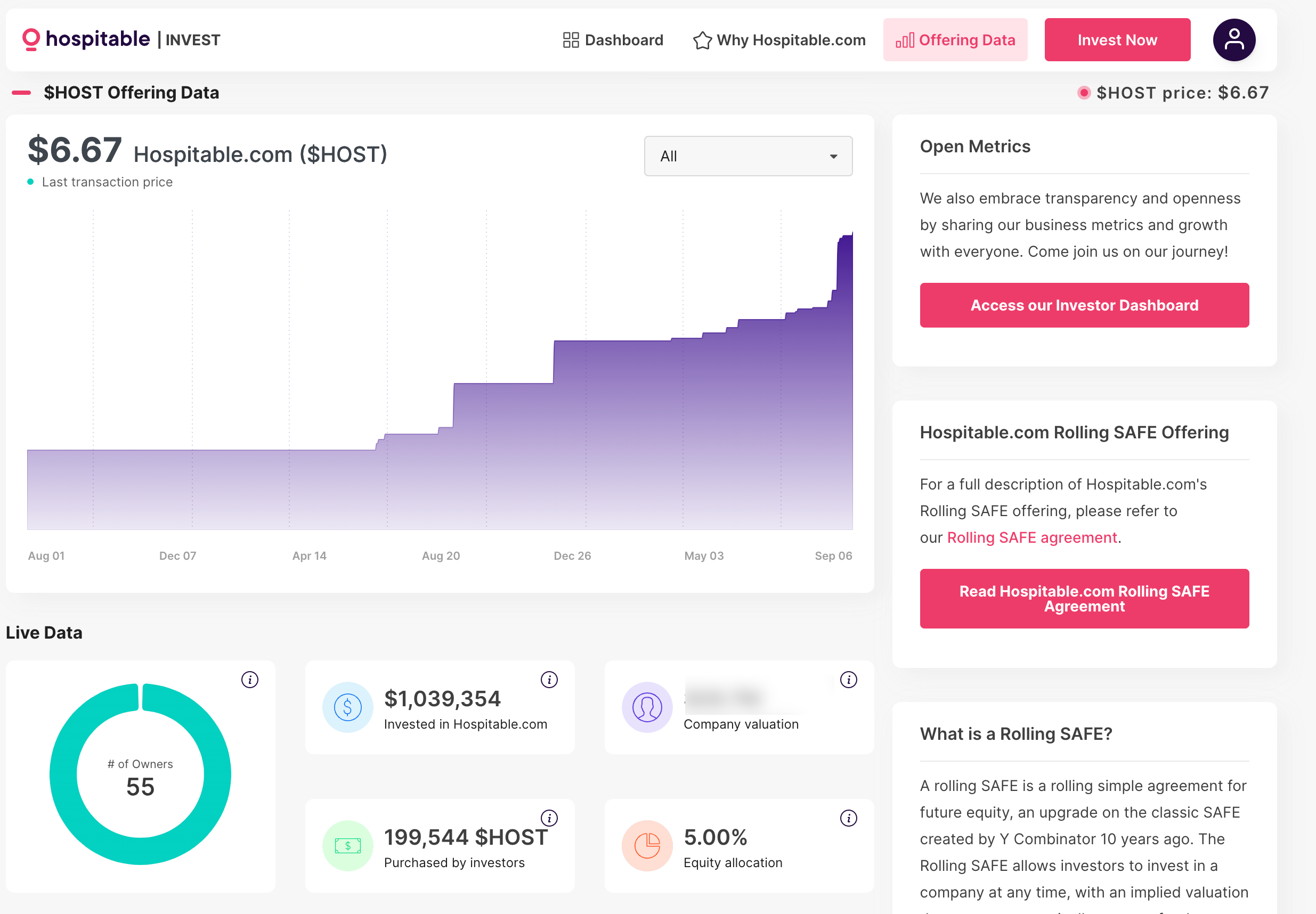

- Hospitable has opened up the ability for customers to invest in the company via a SAFE round -- allowing customers to potentially profit from the company's success. The SAFE investment platform is run on another SaaS product, FairMint.

- Share prices of the SAFE round are, in my estimation, significantly undervalued by 3-4x and offer Hospitable customers a potentially big upside.

- With home loan interest rates higher and home prices up, I chose to use funds that were idle to invest in Hospitable instead of a new rental.

- You should not take this blog as legal, tax, or business advice. Even investing in a good company could result in a complete loss of your investment. Hospitable is also a great software, but isn't the right fit for all STR owners. Do your own research.

A couple of years ago I was managing a single short-term rental via the Airbnb app.

I ran over to the properties to change PIN codes, typed every message and review manually, and tried to market my property locally on my own.

This was okay until I got property 2,3,4, and then was looking at a multi-family purchase which would put me at 10 STR units.

I have a full-time day job and couldn't scale owning STRs. Contemplating moving the STRs back to LTRs, I debated hiring a STR manager but they all want 20-25% of the gross revenue.

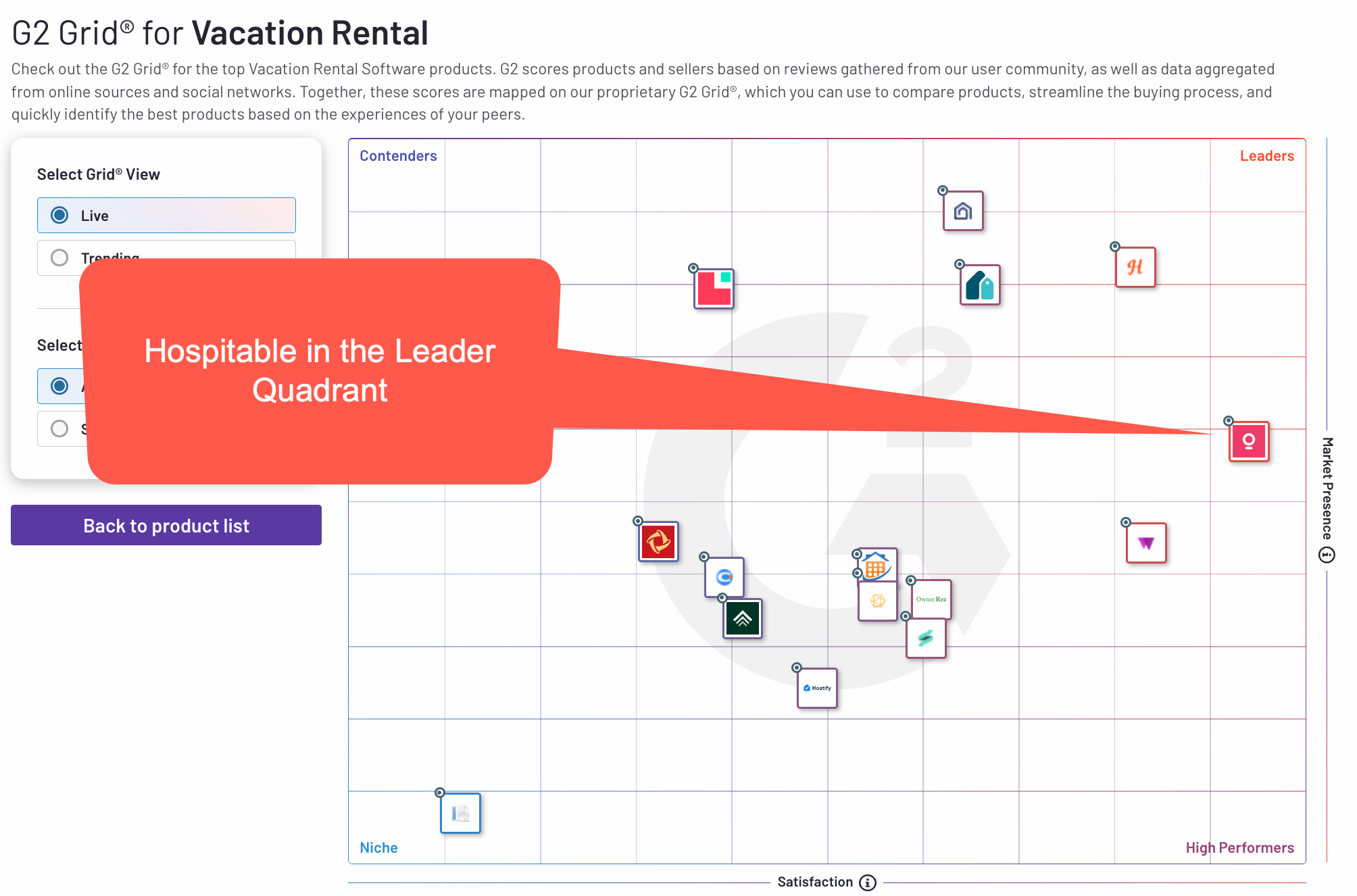

One morning from the comfort of my bed and while I was manually typing instructions to guests checking in that day, I researched the top PMS (Property Management Software) on a review site G2 Crowd.

There I found Hospitable and a number of solid options to host my properties.

I signed up for their Free Trial, connected my Airbnb account, and set up auto-messages and reviews before I got out of bed.

At that point I still wasn't sure which PMS I wanted to choose, but Hospitable was easy to setup, had a mobile app, and allowed for the free trial. I signed up for a few of the other PMS systems but had to get on with my day and told myself I'd look at the others.

The Hospitable app sent me a notification that week that there was a Town Hall.

I thought..that's interesting. I have Town Halls at my company but they are only for company employees. So I hopped on.

The general format of the Town Halls are:

1. Company Updates (open roles, milestones in customers, revenue, etc)

2. Product Updates

3. Open Q/A

At first the Townhalls were on Clubhouse but then migrated to Zoom as the sessions were bringing in hundreds of customers per call.

My takeaways from the Town Halls were:

1. Culture: They made me feel like I was a part of the company. The CEO Pierre and his team shared information I have only seen shared with employees. This radical transparency made me choose Hospitable as my PMS of choice.

2. Hiring: Over time I noticed many customers became employees, which I liked -- having people who actually run and manage short-term rentals can only help to orient the product roadmap.

3. Raving Fans: Even if customers pointed out bugs or issues, the radical transparency made customers raving fans. Hospitable staff seemed to listen to the feedback and executed on many of the suggestions. It felt like we were all building the company together.

One town hall, the CEO mentioned potentially opening up a SAFE round for customers to invest.

Then the 2021 year-end recap email officially announced the ability to invest in Hospitable, making it 'community-owned'

Here are a few questions I had and the responses I found for myself:

1. What is a SAFE round?

(response from ChatGPT)

A SAFE (Simple Agreement for Future Equity) investment round refers to a financing instrument that startup companies use to raise capital in their early stages. Introduced by Y Combinator in 2013, the SAFE offers a simpler mechanism than traditional convertible notes without the complexities and stipulations of debt.

Here's a basic rundown of how a SAFE works:

1. **Not Debt**: Unlike convertible notes, a SAFE is not a loan. There's no maturity date and no interest. This means that if the startup fails, SAFE investors do not have a claim to any outstanding debt, and if the startup is successful but never raises another round of financing, there's no obligation for the company to convert the SAFE to equity or return the invested capital.

2. **Conversion to Equity**: The main purpose of a SAFE is to provide investors with a mechanism to convert their investment into equity in the future, usually upon a priced equity financing round (like a Series A). The exact terms of conversion, including the valuation cap and any discount rate, are specified in the SAFE agreement.

3. **Valuation Cap**: A common feature in many SAFEs is a valuation cap. This is a pre-agreed maximum company valuation at which the SAFE can convert. If a subsequent funding round values the company higher than this cap, SAFE holders still convert as if the company was valued at the cap, thereby getting more shares for their money.

4. **Discount Rate**: Some SAFEs also have a discount rate, meaning that if the company raises money in the future, SAFE investors can convert their SAFE into equity at a discounted rate compared to the new investors.

5. **Provisions**: SAFEs can also have provisions like a "most favored nation" clause, which gives SAFE holders the option to convert their SAFE based on the terms of any subsequent SAFE or convertible note that the company might issue in the future, if those terms are more favorable.

6. **Liquidity Event**: If the company gets acquired or goes public before a SAFE converts, the agreement will typically outline the treatment of the SAFE. It could be a return of the investment, a multiple of the investment, or conversion into equity right before the event.

It's important to understand that while SAFEs have gained popularity due to their simplicity, they are not without criticism. Some believe they can complicate cap tables or create misalignment between founders and investors. Both founders and investors should fully understand the implications and terms of a SAFE before entering into such an agreement.

2. What is an Accredited Investor? (Only accredited Investors could invest in the SAFE round). Response from ChatGPT.

An accredited investor is an individual or a business entity that is allowed to deal in securities that may not be registered with financial authorities. In the United States, the Securities and Exchange Commission (SEC) defines and regulates who qualifies as an accredited investor. This classification is intended to protect potential investors and the financial markets by ensuring that participants in certain high-risk investment opportunities have a sufficient financial base and understanding to bear the risks involved.

The criteria for an individual to be considered an accredited investor, as of my last update in 2021, are as follows:

1. **Income-Based Test**:

- An individual with an income exceeding $200,000 in each of the two most recent years (or $300,000 combined income if married) and a reasonable expectation of the same income level in the current year.

2. **Net Worth Test**:

- An individual or a couple with a combined net worth exceeding $1 million, excluding the value of their primary residence. This includes all assets owned (e.g., stocks, bonds, real estate) minus liabilities (e.g., loans, mortgages).

3. **Professional Certifications and Designations**:

- Beginning in 2020, the SEC added a new provision to the accredited investor definition. Individuals with certain professional certifications and designations, such as Series 7, Series 65, and Series 82 licenses, may qualify as accredited investors.

4. **Knowledgeable Employees**:

- This category pertains mostly to private funds. Knowledgeable employees of a private fund are also considered accredited investors for investments in that fund, even if they don't meet the financial criteria mentioned above.

5. **Entities**:

- An organization with over $5 million in assets, such as a trust or a business, can also be an accredited investor.

- A private business development company or an organization where all equity owners are accredited investors.

6. **Family Offices**:

- Family offices with at least $5 million in assets under management and their family clients, as each term is defined under the Investment Advisers Act.

It's important to note that the SEC reviews these criteria periodically, and they can be updated based on new regulations or changes to existing ones. Before making an investment, individuals or entities should confirm their status as accredited investors based on the most current criteria established by the SEC.

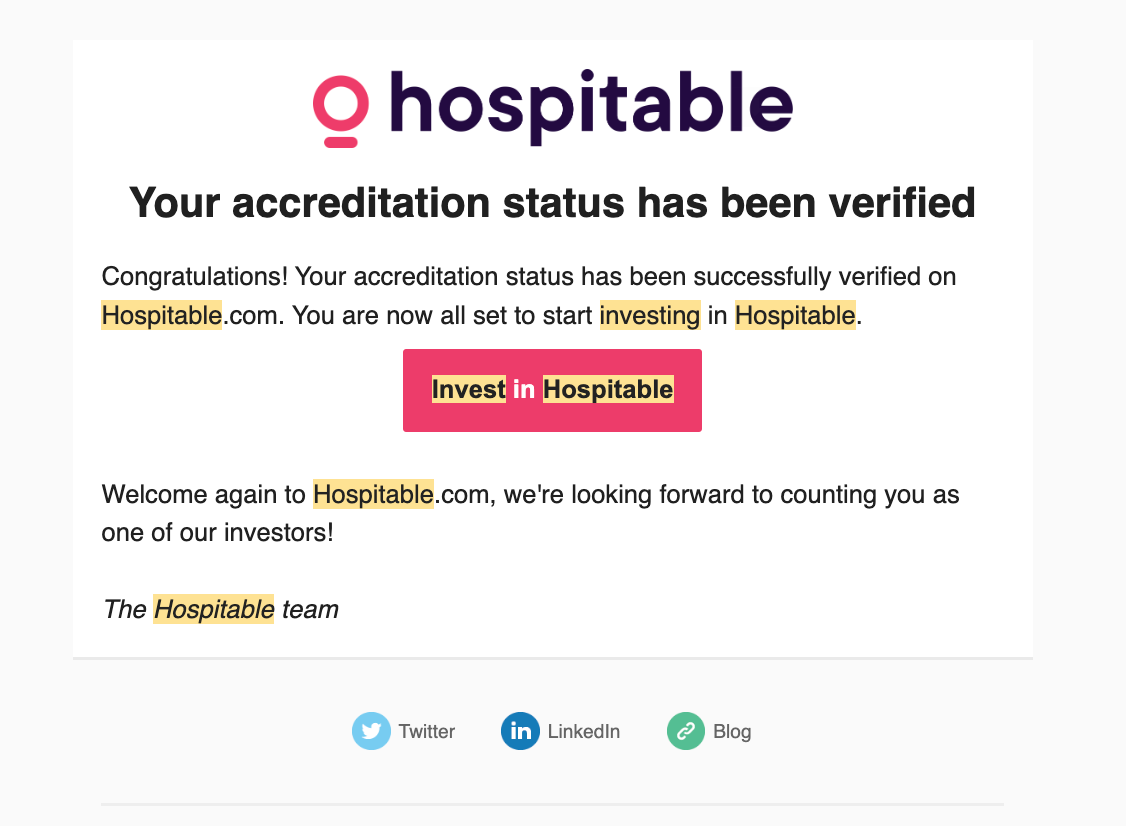

After reviewing the criteria I decided to put in $5k. The signup process was easy via a platform called FairMint.

Using the FairMint system I was able to verify my accreditation status and transfer the funds.

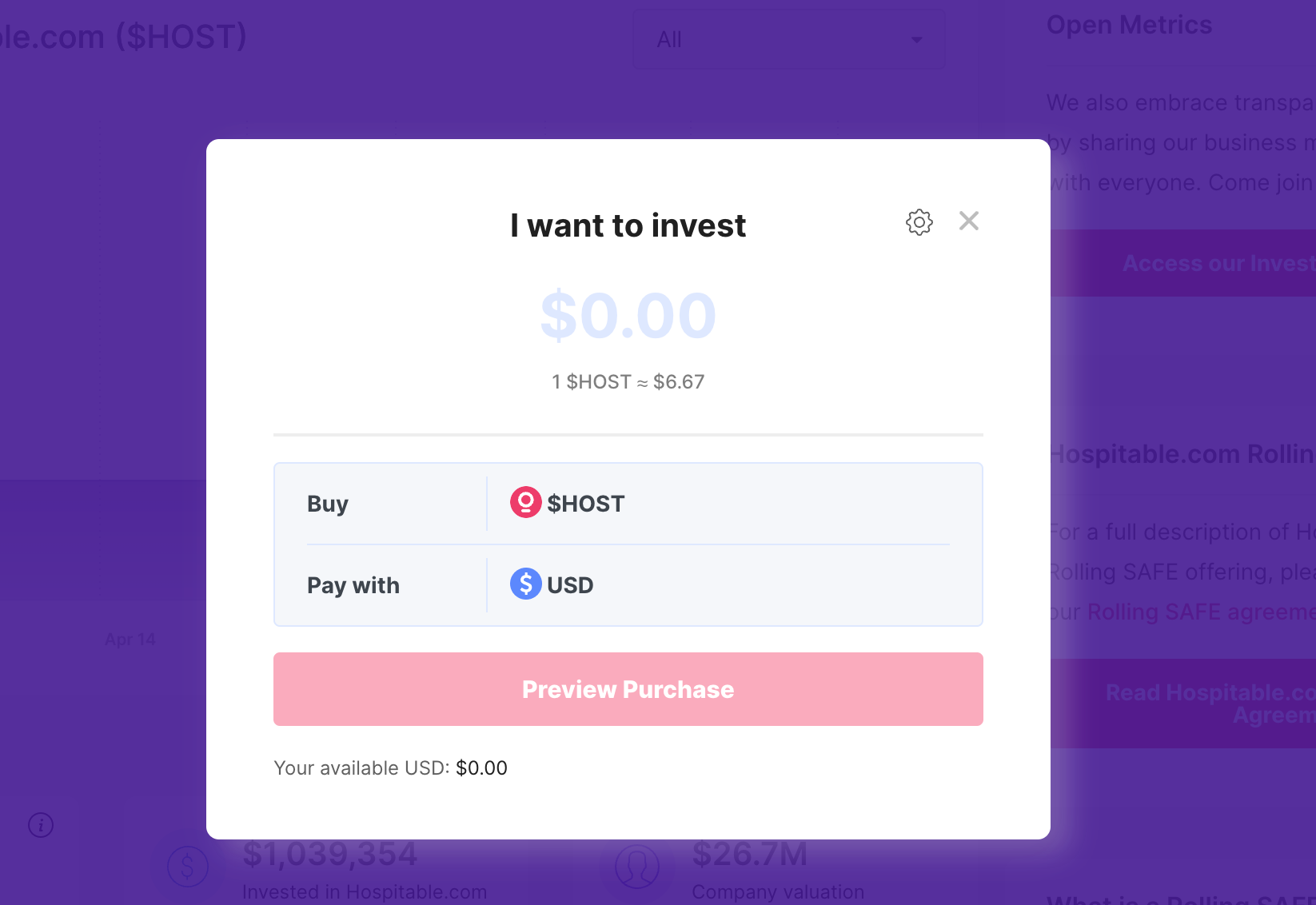

Once logged into the invest portal you can see the estimated price of the token shares and other information on how much has been raised and company updates.

Other FAQs that I found along the way:

1. What is the minimum to invest?

- $2,500

2. Can you invest multiple times?

- Yes, you can make as many investments but the price of the token might be higher at later dates as the company valuation increases.

3. When will I get a return on my investment?

- You might not get one if the company fails. However, the SAFE token is converted to equity upon a majority change in control, either through an acquisition of the company, going IPO, or an investment where an entity owns at least 50.1% of the company. So the investment isn't 'liquid' like investing in the stock market.

What do I think the valuation of Hospitable is?

Typical SaaS companies are valued at ~15x ARR (Annual Recurring Revenue).

The price of the $HOST token via the SAFE round is currently valued at ~ 3.5x revenue.

A $5k investment would therefore be valued at ~ $17,500 @ 3.5x revenue.

But the real market value is 15-20x. We know this by looking at other SaaS valuations and comps like Hostaway raising $135M

As a result, I've made 4 total investments into Hospitable via the SAFE token. Given Hospitable shares high-level company growth numbers on revenue & customers, I've put in more investment as I've seen the company gain more traction and hire strong staff that is executing.

So conservatively I think a $5k investment today as of this blog post is really worth 4-5x ($20-25k).

Now the token could end up being worth nothing if the Hospitable team runs the company into the ground or if there is another COVID-like event that dramatically impacts STR travel or a number of other reasons.

But assuming they continue to grow, I believe the valuation multiple will increase.